Gold, Silver, and the Recession Signal Wall Street Can’t Ignore

By: Paul Goldberg, Senior Editor | JRL CHARTS – LGBTQ Politics

LAS VEGAS, NV — (January 20, 2026) — The Dow Jones Industrial Average fell 900 points today as markets delivered a verdict that no amount of political messaging could soften. While the White House promoted a “private sector boom,” investors saw something very different: slowing growth, rising costs, and policy-driven uncertainty flashing red across the board.

Related LGBTQ News Coverage Links on JRL CHARTS:

• Get the Latest in LGBT Politics USA Exclusively on JRL CHARTS

• Democrats Enter 2026 Midterms With Momentum — But LGBTQ Civil Rights Are Now on the Ballot

• NIH Defies Court-Restored LGBTQ Grants, Confirms Funding Will End in 2026

Markets don’t react to talking points. They react to risk. And today, risk won.

The Market’s Verdict Came First

By late morning trading, the selloff was broad and decisive. Financials, industrials, and consumer-facing stocks all moved sharply lower, reflecting growing concern that economic fundamentals are no longer aligning with official narratives.

Tariff threats tied to Greenland and NATO partners added fuel to the fire, reviving fears of higher import costs, disrupted supply chains, and retaliatory trade measures. Investors didn’t wait for confirmation — they priced the risk in immediately.

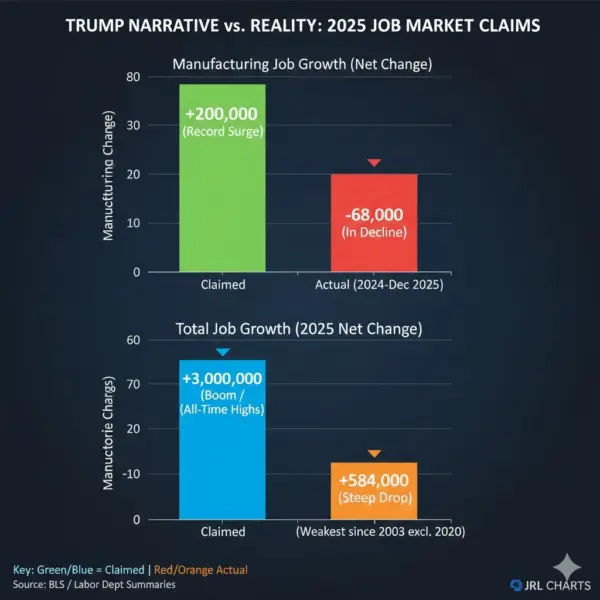

A JRL CHARTS data visualization comparing public job growth claims with verified U.S. manufacturing and employment figures.

The “Private Sector Boom” That Isn’t There

At the center of today’s messaging was the claim that government job cuts are being offset by a stronger, higher-paying private sector. The data does not support that story.

-

2025 recorded the weakest job growth since 2003, excluding the 2020 pandemic year

-

Only 584,000 jobs were added across the entire year

-

Manufacturing lost 68,000 jobs between December 2024 and December 2025

-

The sector is now in its third consecutive year of net contraction

This isn’t a boom. It’s stagnation — and markets are reacting accordingly.

Your 401(k) vs. the Fear Trade

While officials speak in abstractions, households are watching something far more concrete: their retirement balances.

An 869-point Dow drop doesn’t just erase a single day’s gains. For many workers, it wipes out months of slow recovery inside 401(k)s already strained by inflation and rising living costs. That’s why today’s move felt personal — and why confidence continues to erode.

Capital, meanwhile, is doing what it always does when trust breaks down: fleeing risk.

Gold, Silver, and the Recession Signal Wall Street Can’t Ignore

As equities sold off, investors didn’t just move to the sidelines — they rushed into hard assets.

Gold surged more than 3%, clearing $4,700 per ounce, while silver jumped over 6%, approaching $95 per ounce. This synchronized spike is not random. Historically, sharp moves in both metals during equity stress signal a defensive shift that often precedes economic downturns.

Wall Street has seen this pattern before. It rarely ends with a soft landing.

Adding to the warning signs, the Consumer Expectations Index fell to 72.9, well below the 80 level that has historically aligned with recessionary periods. When expectations collapse this far, spending typically follows.

The Distraction Playbook Returns

As markets unraveled, the political focus shifted — toward borders, emergency powers, and familiar cultural flashpoints. It’s a well-worn strategy: redirect attention away from economic pain and toward manufactured urgency elsewhere.

But distraction doesn’t change balance sheets. It doesn’t lower grocery bills. And it doesn’t put money back into retirement accounts.

You can change the channel — but you can’t change the numbers.

The Bottom Line

People aren’t confused. They see higher prices at the store. They feel the estimated $4,850 annual cost-of-living increase tied to tariffs. And they see red when they log into their investment accounts.

That disconnect — between what people are told and what they experience — is exactly why markets reacted the way they did today.

At JRL CHARTS, we don’t chase narratives — we track the data. As warning signals continue to flash across markets, we’ll keep cutting through the spin with facts that actually affect your money.

- LGBTQ Corporate Participation Plunges 65% in 2026 as DEI Retreat Reshapes Business Landscape - February 22, 2026

- Forbidden Fruits (2026) Ignites Buzz With Sapphic Undertones and Witchy Mall Cult Drama - February 21, 2026

- Trump Targets Netflix Board Member Susan Rice After ‘Take a Knee’ Remarks Spark Political Firestorm - February 21, 2026

// Affiliate Disclosure: JRL CHARTS is a digital news and media platform. We do not host, stream, or sell adult content. Some outbound links may contain affiliate tracking to licensed studio-owned platforms (e.g., LatinBoyz, AEBN, BiLatin Men). These links lead to legal, age-gated distributors and are provided strictly for editorial and informational purposes only.